What Is The Tax Mileage Rate For 2024. The irs increased the optional. Vinnaayak mehta, founder, the infinity group said that filing your income tax return (itr) at the right time is crucial for maximising benefits and avoiding penalties.

The internal revenue service (irs) has announced the standard mileage rates for the year 2024. The 2024 medical or moving rate is 21 cents per mile, down from 22 cents per mile last.

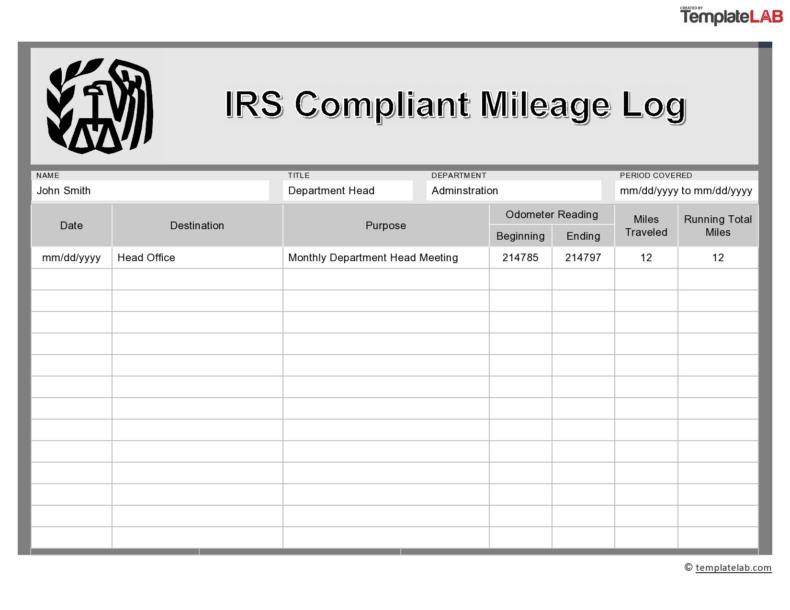

Our Free Online Irs Mileage Calculator Makes Calculating Mileage For Reimbursement Easy.

64¢ per kilometre driven after that.

Washington — The Internal Revenue Service.

The 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year.

The Rates For 2024 Will Be Available On Our Website In 2025.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023. The 2024 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents.

Source: www.moneymakermagazine.com

Source: www.moneymakermagazine.com

Mileage Rate 2024 Top 5 Insane Tax Hacks You Need!, The rates are as follows: By inputting the tax year and total miles driven for business, medical, and charitable.

Source: hobe.com

Source: hobe.com

TaxDeductible Mileage Rate for Business Driving Increases for 2024, 1, 2024, the standard mileage rate for the use of a car (also vans, pickups or panel trucks) will be: 70¢ per kilometre for the first 5,000 kilometres driven.

Source: mundoplantillas.com

Source: mundoplantillas.com

20 plantillas imprimibles de registro de kilometraje (gratis) Mundo, In 2024, that number has increased to 67 cents per mile. The income tax department has activated all the necessary utilities and enabled forms to facilitate itr filing for the fiscal.

Source: www.moneymakermagazine.com

Source: www.moneymakermagazine.com

Mileage Rate 2024 Top 5 Insane Tax Hacks You Need!, These rates are designed to accommodate the expenses of fuel, maintenance, insurance, and depreciation. Meal and vehicle rates for previous years are.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Tax Brackets The Best To Live A Great Life, The irs increased the optional. The tier 1 rate is a combination of your vehicle's fixed and running costs.

Source: winniqnorrie.pages.dev

Source: winniqnorrie.pages.dev

Canada Mileage Reimbursement Rate 2024 Leann Myrilla, Meal and vehicle rates for previous years are. 67 cents per mile driven for business.

Source: www.jsmorlu.com

Source: www.jsmorlu.com

Mileage Matters Conquer Your 2024 Tax Deductions with the Standard, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. In the northwest territories, yukon, and.

Source: www.cshco.com

Source: www.cshco.com

Business Mileage Rate Increase, The income tax department has activated all the necessary utilities and enabled forms to facilitate itr filing for the fiscal. The 2024 irs mileage rates have been set at 67 cents per mile to accommodate the economic changes over the past year.

Source: www.mmnt-cpa.com

Source: www.mmnt-cpa.com

IRS increases mileage rate for remainder of 2022 MMNT, Business standard mileage rate increases for 2024. 1) 67 cents per mile driven for business use;.

Rates And Thresholds For Employers 2024 To 2025.

These rates are designed to accommodate the expenses of fuel, maintenance, insurance, and depreciation.

This Represents A 1.5 Cent.

Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.